san francisco payroll tax rate 2021

Certain taxpayers engaged in administrative office business activities are not subject to the GRT or the payroll tax but instead pay a 14 tax on total payroll expense. Employers pay this rate in addition to the 55 percent business tax rates.

Travelodge Sfo Phone Number 326 South Airport Blvd San Francisco Bersamawisata

Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

. Ad Process Payroll Faster Easier With ADP Payroll. What is the sales tax rate in San Francisco California. Discover ADP For Payroll Benefits Time Talent HR More.

2021 Annual Business Tax Returns. Ad Process Payroll Faster Easier With ADP Payroll. This 6 federal tax on the first 7000 of each employees earnings is to cover unemployment.

5 The current Payroll Expense. San Francisco voters on November 3 2020 approved two propositions that will increase the citys gross receipts tax. Get Started With ADP.

List of Employee Employer Payroll Taxes by US City State. City and County of San Francisco 2000-2021. Companies subject to the Gross Receipts Tax need to file it as part of their.

London san francisco miami remote. The tax rate reaches its maximum level when the ratio reaches 600 to 1 with a maximum tax on payroll of 24 percent or a surcharge on the gross receipts tax of up to 6. Use your San Francisco Business Activity and the SF Gross Receipts Tax Computation.

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the. The tax rate reaches its maximum level when the ratio reaches 600 to 1 with a maximum tax on payroll of 24 or a surcharge on the gross receipts tax of up to 6. Every person engaged in business in San Francisco as an administrative office pays a tax and a fee based on payroll expense attributable to San Francisco.

Tax rate for nonresidents who work in San Francisco. Get Started With ADP. 14 San Francisco Business and Tax Regulations Code Article 12 -1 A 953.

Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24. This is the total of state county and city sales tax rates. In most cases youll be credited back 54 of this amount for paying.

The minimum combined 2022 sales tax rate for San Francisco California is. 2021 Alabama Payroll Taxes - 2021 Alabama Payroll Tax Calculator. The city of san francisco levies a 150 gross receipts tax on the payroll expenses of large businesses.

For more information about San Francisco 2021 payroll tax withholding please call this phone number. Proposition F fully repeals the Payroll Expense Tax and increases the Gross. The Administrative Office Tax AOT is a 14 tax on the San Francisco payroll expense of a person or combined.

Discover ADP For Payroll Benefits Time Talent HR More. The Gross Receipts Tax replaces the Payroll Expense Tax for 2021 and increases the tax rates on most industries. Depending on the business.

Youll find whether your state has. San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City. Payroll Expense Tax.

The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of. When an employee hits the overtime period they are entitled to 15 times or even 2 times their regular pay. This measure would increase that tax as well to.

Beginning in 2021 Proposition F named the Business Tax Overhaul raises. Proposition F eliminates the payroll expense tax and replaces it by increasing the gross receipts tax rate across all industries effective Jan. The Florida payroll tax rate is s six percent of the first 7000 on each employees earnings.

For 2021 Gross Receipts Tax rates vary depending on a business gross receipts and business activity. Businesses that operate only an administrative office in San Francisco currently pay a 14 payroll tax instead of a gross receipts tax. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their.

Resolve routine payroll issues and problems from employees and. Oversee year-end operational close including reconciliation distribution of W2 and tax filing compliance. 8 hours in a workday.

15 x regular rate of.

California San Francisco Business Tax Overhaul Measure Kpmg United States

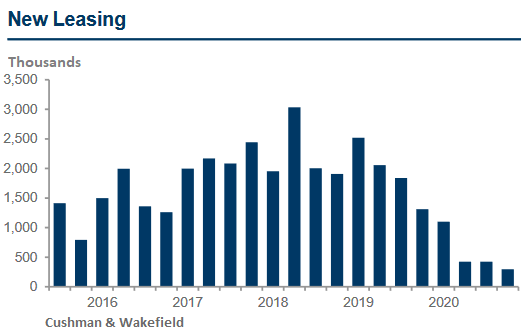

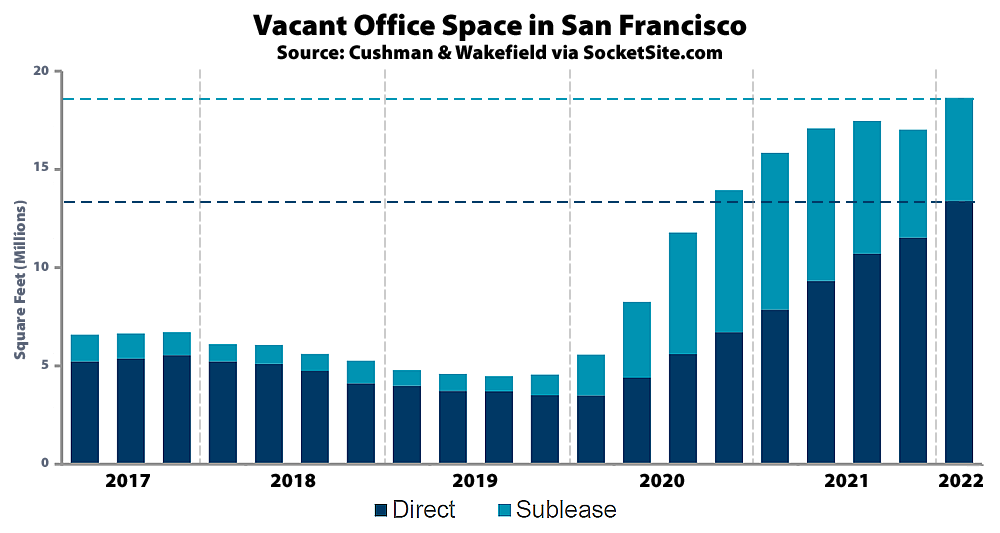

San Francisco Techsodus Unwind Of Office Hogging Sink Office Market Sublease Explodes Leasing Freezes Up Rents Drop Wolf Street

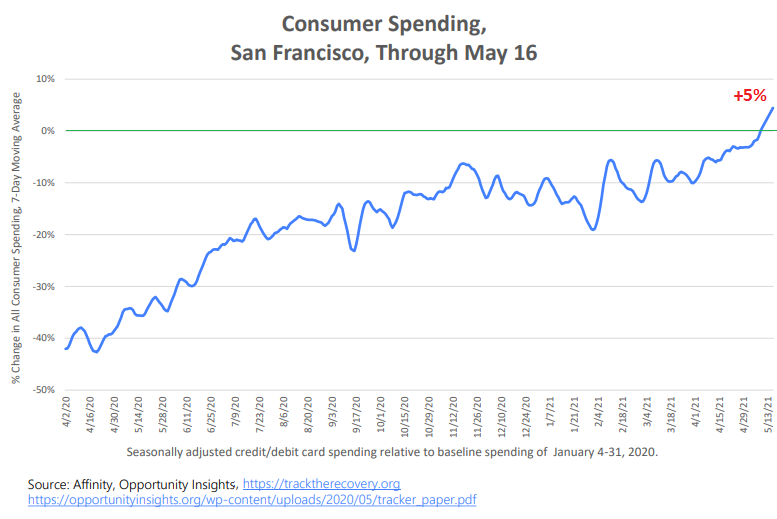

Anatomy Of San Francisco Now Fewer People Jobs Tourists Businesses But More Spending By The Hangers On But That Was Inflation Wolf Street

San Francisco Gross Receipts Tax

San Francisco Set To Begin 2021 With Gross Receipts Tax Increase New Levy On Overpaid Executives To Take Effect In 2022 Andersen

San Francisco S New Local Tax Effective In 2022

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Annual Business Tax Returns 2021 Treasurer Tax Collector

San Francisco Businesses On The Brink After Lockdowns Fires

Coronavirus Timeline Tracking Major Moments Of Covid 19 Pandemic In San Francisco Bay Area Abc7 San Francisco

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

Office Vacancy Rate In San Francisco Hits A Pandemic High

San Francisco Giants Average Attendance 2021 Statista

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium

San Francisco Taxes Filings Due February 28 2022 Pwc

Working From Home Can Save On Gross Receipts Taxes Grt Topia

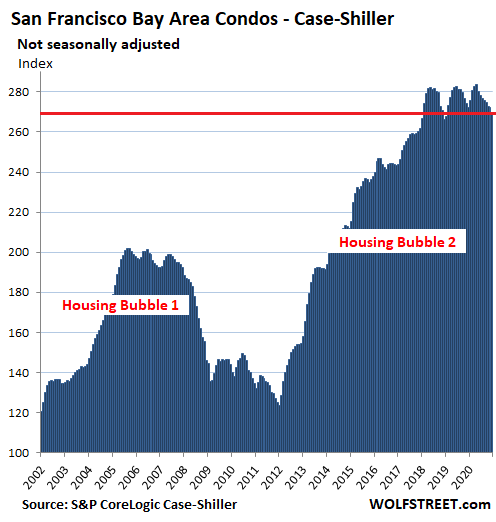

In Housing Market Gone Nuts Condo Prices Sag In San Francisco Bay Area Hover In 3 Year Range In New York Rise At Half Speed In Los Angeles Wolf Street

Annual Business Tax Returns 2020 Treasurer Tax Collector

San Francisco Taxes Where Does The Money Go By Michael Sutyak Medium